Did you know that in April 2024, the gender pay gap for full-time employees was 7.0%? This signifies a slight drop from 7.5% in 2023. Over the past decade, the gap has gradually narrowed, decreasing by about a quarter.

Under gender pay gap reporting legislation, all employers with 250 or more employees must calculate and publish figures each year to show the size of the pay gap between their male and female staff.

What information must be included? Which organisations are obligated to produce a gender pay gap report? How to publish a gender pay gap report? We know you have a lot of questions.

So, here’s everything you need to know about gender pay gap reporting in the UK.

What’s the gender pay gap?

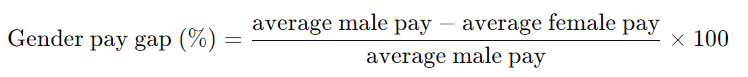

The gender pay gap refers to the difference in average pay between men and women across the workforce. It’s usually expressed as a percentage of men’s earnings. For example, if men earn £40 per hour (on average) and women earn £36, the gender pay gap would be 10%.

The formula is:

It’s important to note that this gap doesn’t always mean women are being paid less for doing the same job as men (that’s unequal pay—which is illegal). Instead, it reflects factors like women being underrepresented in higher-paying roles or industries, taking on more part-time work, or facing career interruptions, often due to caregiving responsibilities.

What is gender pay gap reporting?

Gender pay gap reporting in the UK is a legal requirement for larger employers to share data about the pay differences between their male and female employees. Introduced in 2017, it applies to organisations with 250 or more employees.

If you employ over 250 people, you must report specific figures. These include the median and mean pay gap, the percentage of men and women receiving bonuses, and the proportion of each gender in different pay levels within your company.

The idea behind gender pay gap reporting is to improve transparency about pay inequalities and encourage employers (like you) to take steps to address any disparities.

Which organisations are obligated implement gender pay gap reporting?

As we mentioned above, if you employ 250 or more employees you must report your gender pay gap data.

This includes both private and public sector organisations, as well as charities and voluntary organisations.

If you’re a smaller employer (fewer than 250 employees) you’re not legally required to publish a gender pay gap report. However, you can choose to do so voluntarily.

Not sure about the specific types of employees that need to be included?

It might not always be straightforward to determine your headcount, especially if your workforce includes a variety of contract types. To clarify, here’s how you should calculate it.

Make sure to include the following in your total headcount:

- All employees with a contract of employment, even if they work part-time, job-share, or are on leave.

- Partners on a salary or members of a limited liability partnership (LLP) who are treated as employees for payroll purposes.

Once you’ve counted everyone who fits these categories, if you reach 250 or more, you’ll be required to report your gender pay gap.

Get the latest insights and best practice guides, direct to your inbox.

What information must be included in your gender pay gap report?

Gender pay gap reporting requires you to provide the following information:

- Mean gender pay gap: the difference between the average hourly pay of male and female employees across the organisation.

- Median gender pay gap: the difference between the middle hourly pay rates of male and female employees across the organisation.

- Mean bonus gender pay gap: the difference in the average bonus pay received by male and female employees across the organisation.

- Median bonus gender pay gap: the difference in the middle bonus pay received by male and female employees across the organisation.

- Proportion of employees receiving a bonus: the percentage of male and female employees who receive a bonus payment.

- Proportion in each pay quartile: the percentage of male and female employees in each quartile of the organisation’s pay distribution, including the lowest, lower, upper, and highest pay quartiles.

When do you need to publish your gender pay gap report?

You must report your gender pay gap data on the snapshot date.

The snapshot dates are:

- 31 March for most public authority employers (such as schools, NHS bodies, and most government departments).

- 5 April for private, voluntary and all other public authority employers.

How to publish a gender pay gap report

You’re sharing this information with both your employees and the public.

Therefore you have two things to do:

- Put it on your own website: make sure the report is easily found on your company website.

- Submit it to the government: you have to upload your report to the government’s website. It’s called the Gender Pay Gap Reporting Service, and it’s managed by the Equality and Human Rights Commission (EHRC).

If this is your first time publishing a gender pay gap report, you’ll need to register your organisation and create an account on the Gender Pay Gap Reporting Service web page.

And if you fail to report your data

If you don’t report your gender pay gap data by the deadline, there are a couple things you should be aware of:

- Legal consequences: it’s against the law to miss the deadline. The EHRC can take enforcement action against you. This might include legal proceedings, court orders, and fines.

- Reputational damage: if you miss the deadline, your company will get a ‘late badge’ on the gender pay gap reporting service. This badge is visible to the public, so it could impact how others view your organisation.

5 ways to reduce your gender pay gap

We know every organisation is different, but to help you get started, here are five “easy” ways to reduce your gender pay gap:

Assess your current situation

Start by understanding where the gap exists. Analyse your pay data to identify any disparities between men and women at different levels of the organisation—especially for similar roles.

Review your recruitment and promotion processes

Make sure that your hiring and promotion processes are fair and based on merit. Look at whether there are any biases or barriers that may be affecting women’s progression within your company.

Offer equal opportunities for career development

Make sure both male and female employees have access to the same training, mentorship, and career advancement opportunities. You should create a culture where everyone feels supported in their growth.

Offer flexible working arrangements

Flexible working or remote work options can help to support employees with family or caregiving responsibilities (which often disproportionately affect women).

Implement pay transparency

Being transparent about your pay structures and practices can help encourage fairness (by making sure all employees understand how pay decisions are made).

It also demonstrates to your employees that you’re committed to reducing the gender pay gap.

Fully compliant gender pay gap reporting in 3 simple steps

With Cintra, you can easily stay on top of your gender pay gap reporting. You can monitor data throughout the year—not just at the mandatory snapshot date—giving you a clearer picture of pay patterns, disparities, progress, or workforce dynamics.

To produce a gender pay gap report in just a few clicks, all you have to do is:

- Access the report tab

Open Cintra iQ → Payroll → Payroll Tools → Gender Pay Gap → Snapshot Details. - Select a data period

From the drop-down list, choose the desired gender pay gap data extract period. - Save or print

Once the report appears, you can save or print it as needed.

Find out more about gender pay gap reporting with Cintra

If you want to know more about gender pay gap reporting or our gender pay gap module, click here.

You can also speak directly to one of our payroll experts—they’re always happy to help.

Payroll Legislation Guide

The facts, figures, thresholds and allowances for 2025/26 spanning tax, National Insurance, pensions, statutory payments and more.

Download now