In business, payroll can be a tough nut to crack. And one significant issue that can slow us down, cause mistakes, and stress everyone out is the payroll bottleneck.

The payroll bottleneck is one of the biggest challenges in payroll processes today—spanning industries and organisations of all shapes and sizes. So, if so many organisations are seeing the same challenge, why is process improvement so slow?

Modern payroll has been slower than most industries when it comes to improving productivity and building efficiencies. And the first step to overcoming that is understanding payroll’s biggest challenge—the payroll bottleneck—and specifically where that lies in your organisation.

Understanding the payroll bottleneck

The payroll bottleneck is a phase in the payroll cycle where you have to do huge amounts of work, in a short time. It’s like a traffic jam where everything gets slow and crowded. This sudden surge in workload, towards the end of the payroll cycle, results in operational congestion. The payroll team is forced to scramble to complete tasks, increasing the risk of errors and inefficiencies. This intensified pressure period, where tasks pile up and time runs thin, is what we refer to as the “payroll bottleneck.”

There are between 30 and 40 different processes that need to be done for most payrolls each pay period. Many of them can be fully automated but it’s typical that only 2 or 3 of these processes are done before the payroll cut-off date. This can lead to the vast majority of payroll tasks being completed in a short period of time.

What causes the payroll bottleneck?

1. Unevenness of work

At the heart of the payroll bottleneck is when there’s a flood of tasks crammed into a small window, instead of being evenly distributed over the month. This is a perfect example of unevenness as payroll teams have to perform a large number of tasks in a short period of time. The spike in workload during the payroll processing period leads to an increased likelihood of mistakes, delays, and stress among those responsible for payroll.

2. Timing and organisation hurdles

The problem isn’t just about having too much to do, but also about when and how these tasks are organised. Most organisations have a specific payroll cut-off date. There’s a lot of pressure to make these dates later but payroll teams tend to push back as they simply don’t have enough time to complete everything they need to complete within the timeframe if the date is too late.

Organisations set up these cut-off dates to bring order and efficiency. But sometimes, they do more harm than good. Trying to streamline, they might set a strict lockdown date, a line in the sand where no changes to the month’s payroll can be made. But payroll is always changing, and things that pop up after the cut-off date still need to be handled. This can add to the workload, making things less efficient, not more as the team spend their time dealing with wasteful mistakes.

3. Unsustainable centralisation

There’s also the problem of having too many tasks handled by a centralised function. In many cases, the entire weight of the payroll process is borne by a small team, or often just one individual. This setup creates a significant constraint on the system, slowing it down, amplifying the pressure on the team, and increasing the chances of errors.

4. Impact of errors

Payroll mistakes don’t exist in isolation. A mistake made during one payroll cycle often needs to be fixed in the next one. For example, if a tax deduction is calculated wrong one month, it will need to be corrected the next month. This creates a chain of tasks that need fixing, trapping the payroll team in a never-ending cycle of fixing mistakes.

Overcoming the payroll bottleneck

The payroll bottleneck isn’t a minor glitch that can be patched up with a quick fix. It’s a systemic challenge that calls for serious rethinking and transformation of how payroll is managed.

1. Understanding the need for change

Before anything else, organisations need to recognise the problem and understand the need for change. The payroll bottleneck shows us the deeper issues with the way payroll is often done—the rush of tasks, the concentration of responsibilities, rigid deadlines, and the domino effect of mistakes. It’s the biggest challenge payroll teams face today, yet as a function, payroll is behind many in terms of improvement and efficiencies.

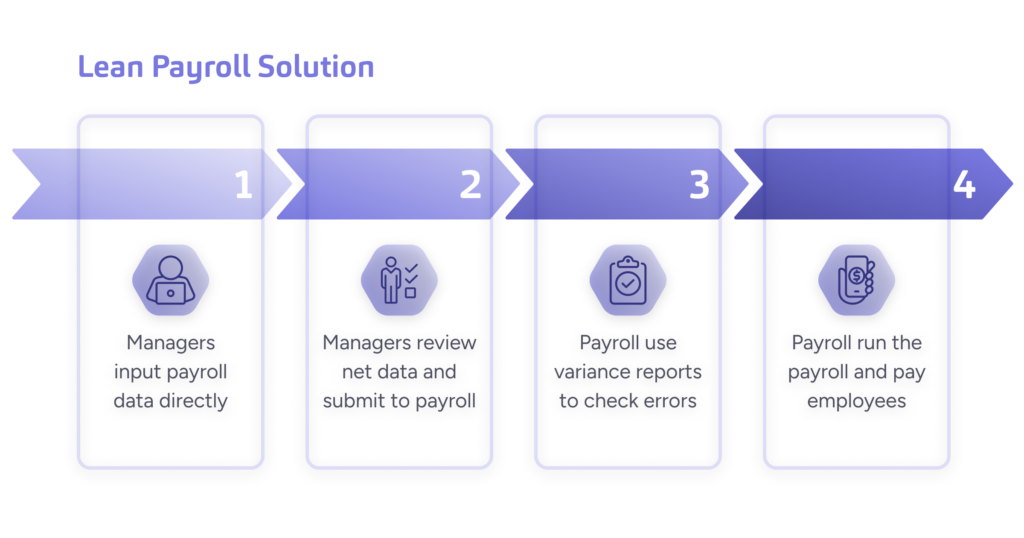

2. Moving tasks before the bottleneck

The key concept in dealing with the bottleneck is to move as many tasks as possible to before the bottleneck. Why does approval have to happen after the cut-off date? If you use modern technology and approaches you can get those responsible for approvals to do this as the period progresses and each change can be approved, leading to the ideal of ‘single piece flow’ when applied to payroll.

3. Embracing delegation

Part of the solution is to rethink how we handle payroll. One way to do this is by decentralising payroll responsibilities and delegating tasks across the organisation. In practice, managers can be given the power to handle certain tasks like inputting data or answering basic payroll questions.

By sharing out tasks, the payroll team can focus on the big tasks like legal requirements, making sure calculations are accurate, and dealing with things like pensions.

4. Automation

Why would you ever get a person to do a task that a computer can do better. There are so many tools that can be used to automate processes and you should look at how you can do this. It doesn’t require expensive developers who are experts in writing code.

Your best friend here is often Excel. It’s not the most elegant solution but checking of numbers and various other tasks can be done quickly and easily with some basic skills in this area. If you don’t have these skills, take a quick course and you’ll be shocked at how many ideas pop into your head of how to improve the process.

A new approach to payroll

The ultimate solution to overcoming the payroll bottleneck? Lean Payroll processes. Lean Payroll is a method of managing your organisation’s payroll processes to make them more efficient and less wasteful—evenly distributing payroll tasks throughout the month to avoid payroll bottlenecks and reduce stress. It also focuses on minimising errors and unnecessary steps in the payroll process, thereby saving time and resources.

By applying Lean practices to our payroll processes, the future of payroll can become:

1. Flexible

An important part of this new approach is flexibility. Payroll is always changing, and we need a system that can change with it. That means being able to handle late inputs, flexible timelines, and a system that can adapt to real-world problems.

2. Empowered

Empowering managers to perform certain payroll tasks doesn’t just lighten the load for the payroll team. It also gets managers more involved and engaged in both process and data. This can lead to fewer mistakes in data input and a better understanding of payroll throughout your organisation.

3. Resilient

Lastly, we need a strong, adaptable payroll system. A good payroll system should be able to handle all the demands of payroll, work well with other systems, and be robust enough to handle changes, additions, and exceptions without falling into chaos.

The future of payroll is Lean

By changing how we approach payroll, organisations can get rid of the payroll bottleneck, leading to a more efficient system, fewer mistakes, less stress for the payroll team, and a more reliable way to meet the company’s financial obligations. A better, smoother, and more efficient payroll process isn’t just a better way to work; it’s a big step towards creating a happier, more productive workplace.

For more information on Lean Payroll practices, download our guide below. Or get in touch if you’d like to chat about what we can do to help.

Introducing Lean Payroll

Walk through the entire concept with PSSG CTO, Seb Aspland—the mind behind Lean Payroll—covering everything from its roots up to a step-by-step guide for implementation

Download your Lean Payroll ultimate guide