Introducing

Lean Payroll

The Practice Redesigning Modern

Payroll Processes

Contents

Jump straight to the section you’re interested in by using the navigation below, or just get scrolling to start from the beginning.

Discover the concept of Lean Payroll—including what it is and its roots in manufacturing.

See how manufacturing industries have benefitted from implemented Lean processes.

Read more about the biggest challenge faced in the payroll industry today, the payroll bottleneck.

Learn more about what drives the payroll bottleneck across all organisations and industries.

Dive into the main concepts underpinning Lean methodology: unevenness, waste, and overburden.

Applying Lean pillars to payroll

Find out how the three Lean pillars can be applied to your payroll to improve your processes.

Understand why decentralisation is the key to implementing a truly Lean payroll process.

Learn more about the benefits of Lean Payroll and the impact it will have on your organisation.

Practical steps for implementation

Learn how to get started with implementing Lean Payroll practices, starting with process visualisation.

See what a true Lean Payroll process looks like in action after eradicating the payroll bottleneck.

Discover the exciting potentialities that Lean Payroll enables for the future of the payroll industry.

Operationalising with technology

Understand the role technology plays in enabling Lean practices—including why it's a supportive partner, not a solution.

What is Lean Payroll?

Lean Payroll turns traditional payroll processes on their head. It draws inspiration from Lean Manufacturing principles which aim to streamline processes and enables you to view payroll not as an isolated task but as a system that can be refined, improved, and made efficient.

In its simplest sense, it focuses on minimising errors and unnecessary steps in the payroll process to save time and resources.

The ultimate goal of Lean Payroll is to turn your payroll department from a cost centre into a strategic asset that can boost productivity, improve accuracy, and contribute to overall organisational success.

Read on to uncover everything you need to know about Lean Payroll practices, and the positive impact they can have in your organisation.

The productivity gap

3% increase

In annual productivity in manufacturing

1% increase

In annual productivity in the service sector

Manufacturing has embedded Lean practices for decades, as a result seeing a consistent 3% annual increase in productivity. This has led to manufacturing operations becoming 3.6 times more productive since 1990. In contrast, service sectors—such as payroll—have seen only a 1% annual rise in productivity, resulting in a more modest 1.5 times increase in overall efficiency over the same time period.

This discrepancy signals a need for a productivity overhaul in payroll processes, and Lean Payroll could be the catalyst for that change. With Lean, we’re not merely adhering to the status quo of payroll processes; we’re actively striving to optimise these processes, making them as efficient as possible so time can be better spent elsewhere.

Introducing the payroll bottleneck

To truly understand the need for Lean Payroll processes, first we have to introduce you to the payroll bottleneck—the biggest challenge faced in payroll processes today.

Essentially, the payroll bottleneck is a phase in the payroll cycle where you have to do large amounts of work, in a short time. It’s like a traffic jam where everything gets slow and crowded. This sudden surge in workload, often towards the end of the payroll cycle, results in operational congestion. The payroll team is forced to scramble to complete tasks, increasing the risk of errors and inefficiencies. This intensified pressure period, where tasks pile up and time runs thin, is what we refer to as the “payroll bottleneck.”

So, what does the payroll bottleneck look like in practice? Here are the traditional tasks in a payroll process, and how many of those have to fit within a short period of time:

What causes the payroll bottleneck?

Uneven distribution of work

At the heart of the payroll bottleneck is a flood of tasks crammed into a small window, instead of being evenly distributed over the month. The spike in workload during the payroll processing period leads to an increased likelihood of mistakes, delays, and stress among those responsible for payroll.

Timing and organisation hurdles

The problem isn't just about having too much to do, but also about when and how these tasks are organised. Most organisations have a specific payroll cut-off date. Everything that happens after this date has a very limited timeframe and this can lead to rushing and errors.

Unsustainable centralisation

In many cases, the entire weight of the payroll process is borne by a small team, or sometimes just one individual. This setup creates a significant constraint on the system, slowing it down, amplifying the pressure on the team, and increasing the chances of mistakes.

The three pillars of Lean

The core Lean methodology is underpinned by three pivotal concepts: unevenness, waste, and overburden. Let’s cover what these Lean pillars are:

Unevenness

Unevenness refers to the variability that can disrupt the smooth flow of operations, leading to inefficiency and mistakes. It's the result of unbalanced workloads, irregular scheduling, or an unpredictable demand, causing a bottleneck that slows down the entire process.

Waste

There are seven key types of waste covering any activity that consumes resources without adding value to the product or service. It comes in many forms, from wasted time and materials to unnecessary movement or steps in a process.

Overburden

Overburden refers to the strain placed on both employees and systems when they are pushed beyond their limits. It's the result of overworking machinery or employees, often leading to mistakes, breakdowns, and burnout.

Applying Lean pillars to payroll

While their roots may be firmly grounded in manufacturing, they hold immense potential for the complex landscape of payroll. Enter, Lean Payroll. Here’s how you can apply the Lean pillars to your payroll processes:

Addressing unevenness

We need to move things out of the payroll bottleneck and get them done earlier. Smooth, regular workflows can help prevent these issues, creating an environment conducive to higher productivity and reduced errors.

Eliminating waste

A central aim of Lean Payroll is to identify and eliminate wasteful steps, reducing the ‘waiting time’ in payroll processes and improving efficiency. It could be the process of producing and validating reports—only to find a mistake that causes a full rework—or waiting for data from other departments before payroll can be processed.

Mitigating overburden

An essential aspect of Lean Payroll lies in sensible planning and capacity consideration. This isn't about extracting every bit of energy and time from the workforce; it's about intelligent allocation of tasks. By ensuring a carefully balanced workload, the cycle of overburden can be broken—resulting in a healthier and more productive payroll team.

Lean Payroll in practice: decentralisation

The next big question you’re likely asking is, how can you possibly even out work, eliminate waste and reduce overburden? One of the answers lies in decentralising payroll responsibilities.

Instead of having a single centralised team managing all payroll activities, the responsibilities are distributed across different levels and departments of your organisation.

The primary focus of the payroll team shifts towards managing critical legal and accuracy aspects. Their expertise becomes invaluable in ensuring compliance with various regulations and maintaining the precision of payroll calculations. They serve as a point of reference for complex payroll matters and are responsible for maintaining a deep understanding of evolving payroll laws.

On the other hand, managers and department heads play an active role in the payroll process. They take charge of specific tasks such as inputting payroll data and updating employee details. This delegation not only empowers managers with a sense of ownership over their team’s payroll-related activities but also speeds up the process by eliminating unnecessary back-and-forths between different departments and the central payroll team.

By engaging managers and other stakeholders directly in the payroll process, your organisation benefits from improved accuracy and responsiveness. This approach fosters a culture of accountability, where managers are more attuned to the needs of their team members and the accurate documentation of their work hours and leaves.

The benefits of Lean Payroll

- Manager engagement: empower managers by decentralising some payroll tasks, fostering a culture of ownership and accountability. With greater control and decision-making power, managers become more engaged in payroll processes.

- Employee trust and satisfaction: enhance payroll accuracy and boost employee trust and satisfaction, directly contributing to improved morale and productivity.

- Collaboration: create clear communication channels between managers and payrollers, ensuring they collaborate seamlessly on streamlined processes.

- Organisational performance: streamline operations and free up valuable time, directly contributing to faster decision-making and higher productivity.

- Strategic value: with efficient processes and more available data, payroll departments can provide valuable insights into the workforce and enable strategic decision making.

GUIDE

Everything you need to know about Lean Payroll

Walk through the entire concept with PSSG CTO, Seb Aspland—the mind behind Lean Payroll—covering everything from its roots up to a step-by-step guide for implementation. Packed with actionable guidance and thought leadership, it’s a guide not to be missed!

Download your Lean Payroll guide

Practical steps for implementing Lean Payroll practices

Before you decentralise your payroll responsibilities, it’s important to review your payroll process and refine what you’d like the new process to become. Here are a series of steps for you to follow to help successfully implement Lean Payroll practices:

Map out your process

Tools such as Trello aren’t limited to project management. Use them to graphically depict each step in your payroll process, highlighting complex or cumbersome areas.

Visualise your workflow

Create a chart to capture the entire payroll journey – from its beginning, through every step, to its conclusion. This visual guide can efficiently point out potential challenges and areas requiring attention.

Identify the bottlenecks

Using your diagrams, look for steps where hold-ups consistently happen—most likely in the payroll bottleneck. By focusing on these specific issues, you're better equipped to address them.

Remove unnecessary processes

Find tasks that might be repeating themselves without adding value. Eradicating or combining these tasks can make your process more efficient and reduce the chances of errors cropping up from redundant operations.

Refine approval processes

Approval processes are often overcomplicated, for no good reason. If you've been having four stages of checks, is it possible to accomplish the same accuracy with only two?

Trial and feedback

Change is often most effective when it's gradual. Start with a smaller scope before implementing on a grand scale. This allows you to observe effectiveness and pinpoint areas of improvement without causing disruptions across the board.

Lean Payroll at the Cintra Conference 2023

Catch Seb Aspland, PSSG CTO, discuss Lean Payroll at the 2023 Cintra Conference. Seb is obsessed with building great tech products that genuinely solve real-world problems. One of his biggest drivers is hearing how much customers love the products and knowing they’re somehow making a positive impact in the world. That desire to create a positive impact is where his passion for Lean Payroll was born.

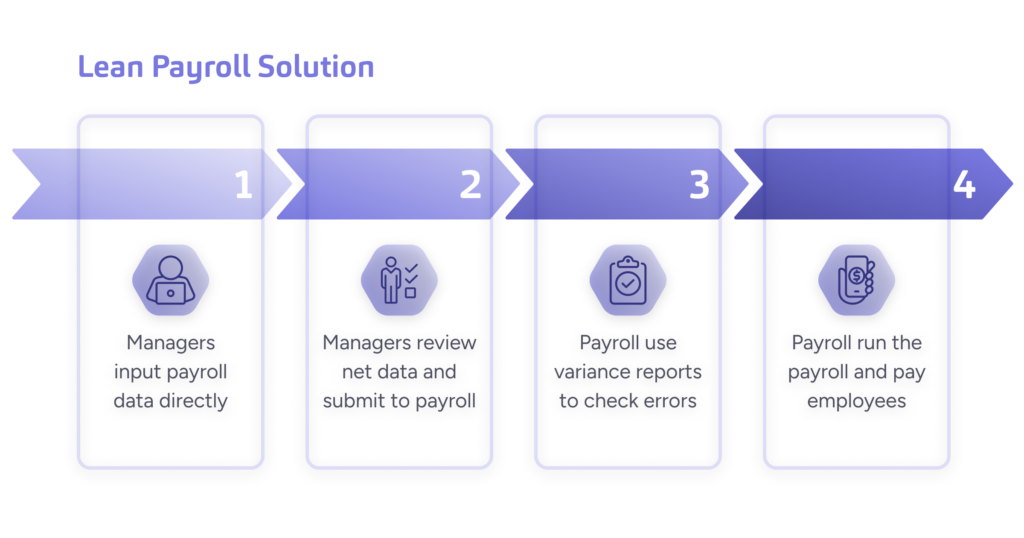

What a Lean Payroll process really looks like

A diagram that once showed a complicated payroll process and an array of payroll bottlenecks, easily becomes a process that looks something like this once you’ve successfully implemented Lean Payroll practices:

Measuring the impact of Lean processes

Accuracy

Accuracy is the bedrock of trust in any payroll system. Errors, no matter how trivial they may seem, can erode confidence and lead to dissatisfaction among employees. Measure how many mistakes you’re carrying over from one payroll cycle into the next.

Time

Time is money, and delays in payroll can have cascading effects throughout your organisation. Understanding where time is lost allows you to target those areas for improvement. Measure the total time your payroll process takes, with particular attention to any periods of delay or waiting.

Cut-off

An early payroll cut-off date can lead to delays in payment for new hires or those with changes in their payment details. It's not just about timing; it's about fairness and responsiveness. If someone joins on the 15th of the month, must they wait 6-7 weeks to get paid? The later the cut-off date, the better.

The future of payroll with Lean practices

Modern, flexible, precise, agile.

The future of payroll in a lean environment could be profoundly different from what we see today. Two key concepts anchor a very futuristic vision, reflecting a shift in how modern payroll could be managed:

Payroll cut-off near payday

In true Lean Payroll practices, payroll cut-off could be as close as one to two days before payday. Changes and updates are processed in real-time, allowing a continuous and unobstructed flow of information. This real-time processing eradicates bottlenecks empowers total flexibility and responsiveness.

On-demand payday

Through advanced automation and real-time processing, the rigid monthly payday could become a thing of the past. Payroll is updated continually and accurately, enabling a system where employees can request payments on-demand, tailored to their unique needs and preferences.

Operationalise Lean with technology

Technology should facilitate the newly defined process, not dictate it. It must be tailored to the specific needs and workflows of your organisation.

Culture and process come first: Technology’s real value comes into play after changes in culture, process, rules, and structure have been implemented. New technologies alone won’t fix underlying issues; they amplify the benefits of well-designed processes.

Start with understanding, then implement. What are you going to do? How will technology support it? Once clarity is reached, technology can be implemented to bolster the new process.

Your supportive partner

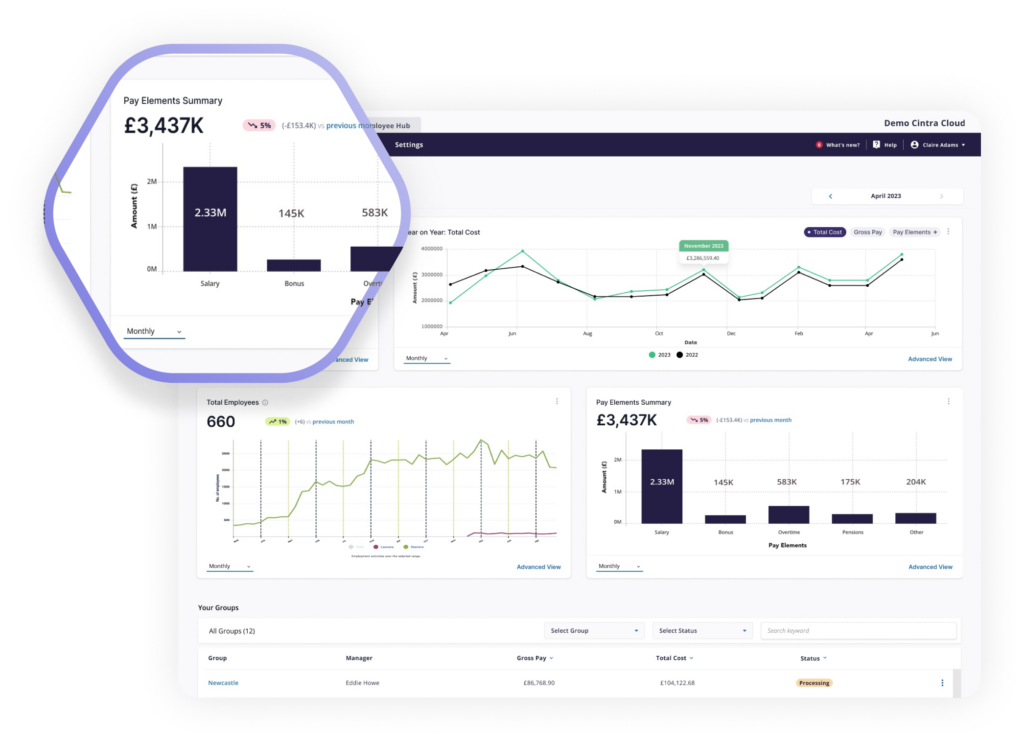

Transform how your payrollers work with managers

Cintra Groups gives your managers the power to own and enter payroll data for their teams, in real-time. With payrollers and managers working together in one centralised platform, there’s no more waiting for spreadsheets, no more invisible payroll data, and no more inconsistencies in process.

Save time

Simplify your entire payroll cycle and remove manual, tedious processes—resulting in huge time savings.

Track payroll in real-time

Gain a real-time window into your entire payroll cycle with instant updates and gross-to-net calculations.

Improve collaboration

Empower payrollers and managers to make better, data-driven decisions together.

Reduce costs

With huge reductions in resource and more accurate payroll processes, reduce the cost of your cost centre.

BROCHURE

Turn your cost centre into a profit centre

Modernise how your organisation processes payroll by segmenting your organisation in Cintra Groups and delegating payroll responsibilities to your managers. Speed up and streamline your processes to save time, money and resource.

Download your Cintra Groups brochure

Lean Payroll in practice

5,890 hours saved annually

Arcus swapped their time-consuming, timesheet-based payroll process for Cintra Groups to pay their 4,500+ strong workforce and saved 15% of their managers resource annually.

50% of time saved on approvals

Olleco relied on manual payroll processes and spreadsheets to process payroll for their 700+ colleagues. By implementing Groups, they reduced time taken for manager approvals by 50%.

See Cintra Groups in action

Our payroll and HR experts are always on hand to discuss payroll challenges in your organisation. Because why settle for ordinary, outdated payroll processes?

Get in touch to see Cintra Groups in action and hear more about the incredible results that Groups users have seen.