If you’re here, it can only mean one thing. You’re thinking about switching payroll companies.

Maybe you’re not getting the customer service you expect. Maybe you feel your software has limited functionality and that there’s a better payroll provider out there.

There are a hundred different reasons why you might be thinking about switching payroll companies. And your first thought is probably: this is going to be tricky.

You’re not entirely wrong; the process is time consuming, and it can be complex. But the end result is always worth it—just as long as you find the payroll service that’s right for you.

While payroll may be complicated, switching to a simpler payroll solution doesn’t have to be!

To make your decision as painless as possible, let’s answer all the questions that typically come up. When’s the best time to switch payroll providers? Is switching payroll providers mid-year a realistic possibility? And the big one, how to switch payroll providers?

The main reasons you’re considering switching payroll companies

If you’re still on the fence about whether you need a new payroll provider, take a look at some of the most common pain points we’ve heard from other companies. If too many of these sound familiar, you have your answer.

Outgrown the current provider

- “We’ve grown significantly, and our payroll needs have expanded beyond what the current supplier can handle.”

- “It’s clear they’re not set up to support the size or complexity of our operations anymore.”

Lack of functionality

- “The system just doesn’t offer the tools or features we need to manage payroll effectively.”

- “Things like automation, reporting, or integration are either missing or too basic.

No progress or innovation

- “The supplier hasn’t introduced any new features or offerings in ages.”

- “It feels like they’ve stagnated while we’re looking to keep improving.”

Cost concerns

- “For what we’re getting, the cost doesn’t feel justified anymore.”

- “We could likely find a better solution for the same price (or less).”

Supplier mistakes and compliance issues

- “There have been too many errors, which not only disrupt our processes but also put us at risk for compliance failures.”

- “Payroll accuracy is non-negotiable, and their track record isn’t reassuring.”

Poor service and response times

- “Support is slow, and when we need help, we’re often left waiting or chasing them.”

- “We need a partner that’s responsive and reliable.

Integration challenges

- “The current system doesn’t play well with our other tools and software.”

- “This creates extra manual work and inefficiencies we shouldn’t have to deal with.”

What’s the average timeline when switching payroll companies?

Switching payroll companies generally takes between two and six months, but the exact timeline can vary depending on a couple key factors:

First, it depends on the size of your company. If you’re a smaller company, it might be relatively “quick”. If you’re a larger business with more employees (at least 250) you’ll need more time.

Secondly, it depends on the complexity of your payroll. The more intricate your payroll structure is, the longer the setup process is likely to take. For example, businesses in sectors like education often have unique requirements, such as handling multiple posts or jobs per employee, assigning spine points on pay scales, and managing pension contributions.

What’s the best time to switch payroll providers?

The best time to switch payroll providers really depends on your circumstances, but April is often considered ideal. It marks the start of the tax year, which means you won’t have to deal with carrying over year-to-date (YTD) figures for employees. Starting fresh in April can make the transition much smoother.

However, there’s a catch—April is also the busiest time for payroll providers. If you’re planning for April, it’s crucial to prepare well in advance and lock in your provider early to avoid delays.

For smaller payrolls, December might be a surprisingly good option. While it’s often considered difficult due to the holiday season, the lower activity level in some businesses and fewer complexities can make it manageable for small setups.

Bear in mind the time required for setup and implementation. Regardless of when you plan to switch, it’s wise to choose your new provider at least six months in advance to make sure everything is ready to go live on schedule.

How difficult is switching payroll companies mid-year?

Switching payroll providers mid-year is definitely doable, but it comes with a few extra steps. One of the main challenges is dealing with YTD figures. Since you’re changing providers partway through the tax year, these figures need to be gathered to make sure employees’ records remain accurate.

The good news is that if your current provider can issue the YTD figures in a clear format, this process becomes much more straightforward. The new provider will use these details to set up your payroll correctly, so there’s no disruption in pay or reporting.

The reasons people don’t switch payroll companies

Let’s look at the top 3 reasons people don’t switch payroll companies, and why they aren’t as scary as you think:

Data security concerns

Switching payroll companies consists of transferring lots of sensitive employee information from one payroll system to another. Naturally, you’d be concerned about the security of your data.

Let’s look at how the data migration process works and the emphasis which is placed on security throughout the process.

The data migration process is carefully planned to make sure everything runs smoothly and securely. It’s broken down into various phases:

Planning: this is the foundation of the process. It starts with a project kick-off where everyone involved agrees on the goals, timelines, and who’s responsible for what.

Data cleansing: next, you need to look into your data—what needs to be moved, its format, and how it will be transferred securely. Before anything is moved, the data is “cleansed,” meaning it’s checked to make sure it’s accurate, up-to-date, and free of errors.

Build: once the planning is done, it’s time to start transferring the data. This is called the data take-on, where the information is moved into the new system and formatted correctly.

Reconciliation: after this, a reconciliation process makes sure nothing’s been lost or misaligned during the transfer by comparing the old and new systems’ data.

Test: during testing, a parallel run is often done, where both the old and new systems operate side by side to confirm the new system processes data accurately. Another round of reconciliation is done here to catch any discrepancies between the systems.

Training: before going live, there’s a testing and training phase. Training makes sure that everyone using the new system knows how to operate it confidently.

Go live: finally, it’s time to switch over. The project team confirms everything is ready, and the system goes live. There’s also a handover from implementation to the live service team, who take over and make sure the system continues running smoothly with real, live data.

From start to finish, data is handled using secure systems and protocols to make sure it’s protected at every stage.

System & process disruption

Some companies are reluctant to switch payroll providers because they feel it will disrupt their operations or require significant time and resources to manage the transition.

So, with that in mind, how does a payroll provider like Cintra make sure that there’s no process disruption for the company during the switch?

Comprehensive support at every step

We’re with you from the very start. From understanding your current setup and gathering requirements to offering post-go-live assistance—we guide you through every stage.

Tailored to your business

No two companies are the same, and we get that. We take the time to learn about your specific needs—how your payroll is structured, the regulations you need to follow, and how your data flows across systems.

Then, we create a solution that works perfectly for you, without trying to squeeze you into a one-size-fits-all approach.

Smooth and secure transition

Our methodical approach makes sure that the transition doesn’t interrupt your day-to-day operations.

- Parallel runs: we test the new system alongside your current one to make sure everything matches up before going live.

- Reconciliation: we double-check every figure so there are no surprises.

- Thorough testing: we simulate different scenarios to make sure the new system handles everything just as it should.

Expert training for your team

We know that a new system is only as good as the people using it. That’s why we provide training to make sure your team is comfortable and ready to go. Whether it’s hands-on workshops or quick guides, we tailor the training to suit your team’s needs.

Ongoing support

Our relationship doesn’t stop when the new system goes live. We stick around to provide support whenever you need it. From troubleshooting to staying ahead of regulatory changes, we’re here to make sure your payroll runs like clockwork.

Cost & complexity of initial implementation

It’s true that switching payroll companies involves some additional costs. But every migration is different, and the cost will depend on your company and your specific needs.

Some of the main factors that will impact the cost of your initial implementation are:

- The scope of the migration (e.g., number of systems, payrolls, data volume).

- The complexity of the data and integration needs.

- Additional requirements such as training, support during the transition, and customised setups.

Because every company’s situation is different, there’s no one-size-fits-all price. That’s why it’s so important to clearly define your requirements early on—it helps the provider give you an accurate estimate and make sure there are no surprises along the way.

Think of implementation as a valuable one-off investment—it’s a professional service designed to tailor the system perfectly to your business, making sure you get the most out of it from day one.

Are there any common mistakes to avoid when switching payroll companies?

A common mistake is focusing too much on cost and not enough on your specific needs.

It’s easy to stick with what you know, but sometimes the same solution isn’t the best fit anymore. Before making the change, take time to assess what you truly need—whether that’s improved speed, better customer service, or additional features.

Get the latest insights and best practice guides, direct to your inbox.

How to switch payroll providers

As you now know, switching payroll providers isn’t as simple as picking a new one and signing on the dotted line. There’s a lot more to it.

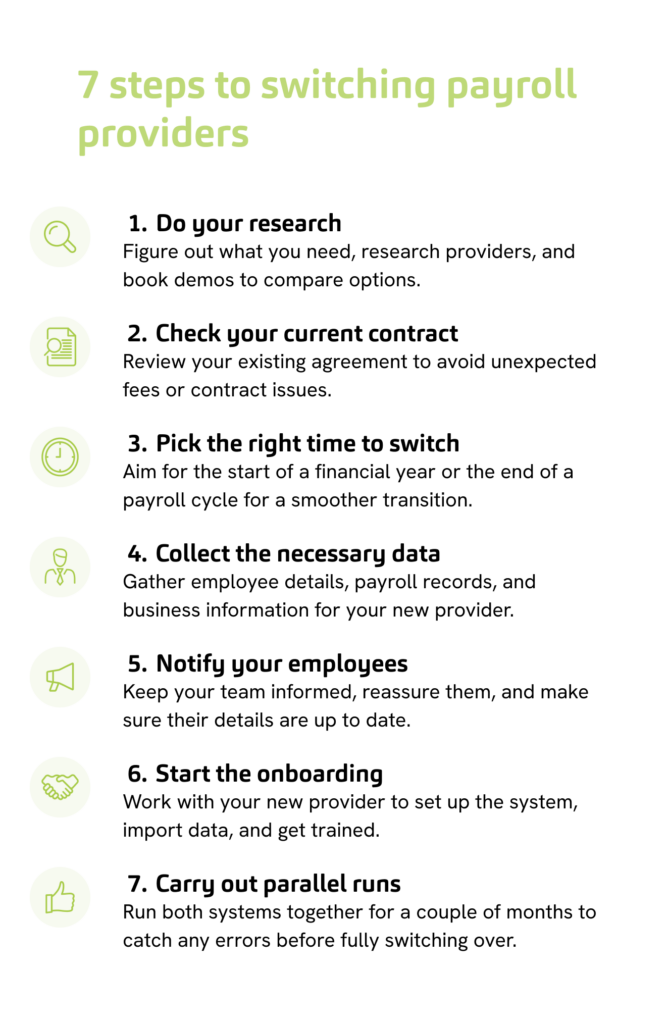

Let’s look at an easy-to-follow 7-step process for switching payroll companies:

1. Do your research

Before you jump into a commitment head first, you need to determine what you need from your payroll provider. Ask yourself:

- Do you need specific features like automated compliance updates or integration with other systems?

- How many employees does it need to accommodate?

- What’s your budget?

Once you’re clear, start with some online research then arrange initial conversations/discovery calls with providers to see if they can meet your needs. Then move onto demos and compare their services.

2. Check your current contract

Have a close look at your existing agreement.

- Are you locked into a contract? If so, check when it ends or if there are termination fees.

- If it’s a monthly subscription, find out how much notice you need to give before switching.

Knowing these details will help you avoid unnecessary costs or interruptions in payroll processing.

3. Pick the right time to switch

Timing is crucial (as we covered above).

Switching payroll providers at the start of a new financial year is ideal because it simplifies data transfer and reporting. However, if you can’t wait, consider switching at the end of a payroll cycle to minimise disruption.

It’s all about what works for you, not your new payroll provider.

4. Collect the necessary data for the new provider

This is the part where you’ll gather all the essential information your new payroll provider needs to get started.

Here’s a short summary of what you’ll need:

- Employee details: bank account info, national insurance numbers, tax codes, start dates, payment frequency.

- Payroll records: this includes salary payments, deductions, staff absences, PAYE notices, and any benefits or expenses.

- Business information: Your PAYE reference number, business structure, and the total number of employees.

5. Notify your employees

Keep your team in the loop. Let them know about the change, explain why you’re switching, and reassure them that their pay won’t be affected.

This is also a good opportunity to confirm their personal details are up to date.

6. Start the onboarding

Begin the official onboarding process with your new provider. They will typically guide you through the setup, importing your data, configuring settings, and training you or your team to use their system effectively.

7. Carry out parallel runs

Once onboarding is underway, run your old and new payroll systems side by side for a month or two. This parallel run allows you to compare results and catch any discrepancies before going live with the new provider.

How to inform your employees about an upcoming switch in payroll providers

The best way to inform your employees is to use all the communication tools at your disposal and keep them in the loop every step of the way. Start with a company-wide announcement, whether it’s through a meeting, email, or your employee portal, to explain what’s happening, why, and how it will benefit them.

As the go-live date gets closer, send regular updates to reassure everyone that the transition is on track. Make sure your employees know if there’s anything they need to do, like confirming their personal details or setting up accounts with a new employee portal.

It’s also a good idea to share clear instructions on how to use any new systems, along with an FAQ or Q&A session to address common concerns. The more transparent and informative you are, the smoother the process will feel for everyone involved.

Why you should choose Cintra as your new payroll provider

We offer a comprehensive and scalable payroll solution, backed by over 40 years of expertise, and excellent customer service.

Here’s a brief overview of what makes us a top choice for businesses of all sizes.

Key benefits

- Expertise in payroll and tax regulations: Cintra offers external expertise to handle complex payroll and compliance requirements.

- Scalable solutions: our PEPM (Per Employee Per Month) pricing model adjusts to your business growth.

- Advanced data security: we place a strong emphasis on keeping sensitive employee and payroll data safe. Our systems are ISO-accredited, rigorously audited, and hosted securely in the cloud with comprehensive protocols to prevent and manage cybersecurity risks.

Why people choose us

- 99.99% accurate payroll

- Reliable, qualified team of payrollers

- Data security

- Ease of use

- Comprehensive reporting features

- Responsive, holistic service

Standout features

- Clear payroll timetable

- Market-leading cloud-based portal

- Simple data entry

- Live reporting

- Instant, automated calculations

- Integrated holiday and absence management

How easy is migrating your payroll to Cintra?

From day one, you’ll be working with an experienced implementation team that knows the ins and outs of payroll migration.

Our onboarding process is designed to be as clear and straightforward as possible—so you’ll always know what’s happening and what comes next.

To help you and your team throughout the migration process, we provide numerous training materials along with templates to help you organise and transfer your data.

When it’s time to go live, there’s a smooth handover to our Outsourced Support Services (OSS) team. Their goal is to make the transition as easy and stress-free as possible.

We’re the last payroll service you’ll ever need

If you want to know more about us, you can download our payroll services brochure. Or, if you’re ready to see Cintra in action, you can book a demo with one of our payroll experts.

Payroll Outsourcing Buyers Guide

Download everything you need to know in your payroll outsourcing buyers journey—covering services and solutions in depth.

Download your buyers guide